Fraud

FraudJuly 11, 2023

4 Senior Scams and How to Spot Them

4 Senior Scams and How to Spot Them

Did you know that people over age 60 lost more than $1.7 billion to fraud in 2021, increasing 74% from the previous year, according to a recent FBI report. More than 90,000 seniors were scammed out of an average of about $18,000 each; some more than $100,000! These four Senior Scams are the most common. Knowing how to spot elder fraud can be your best defense.

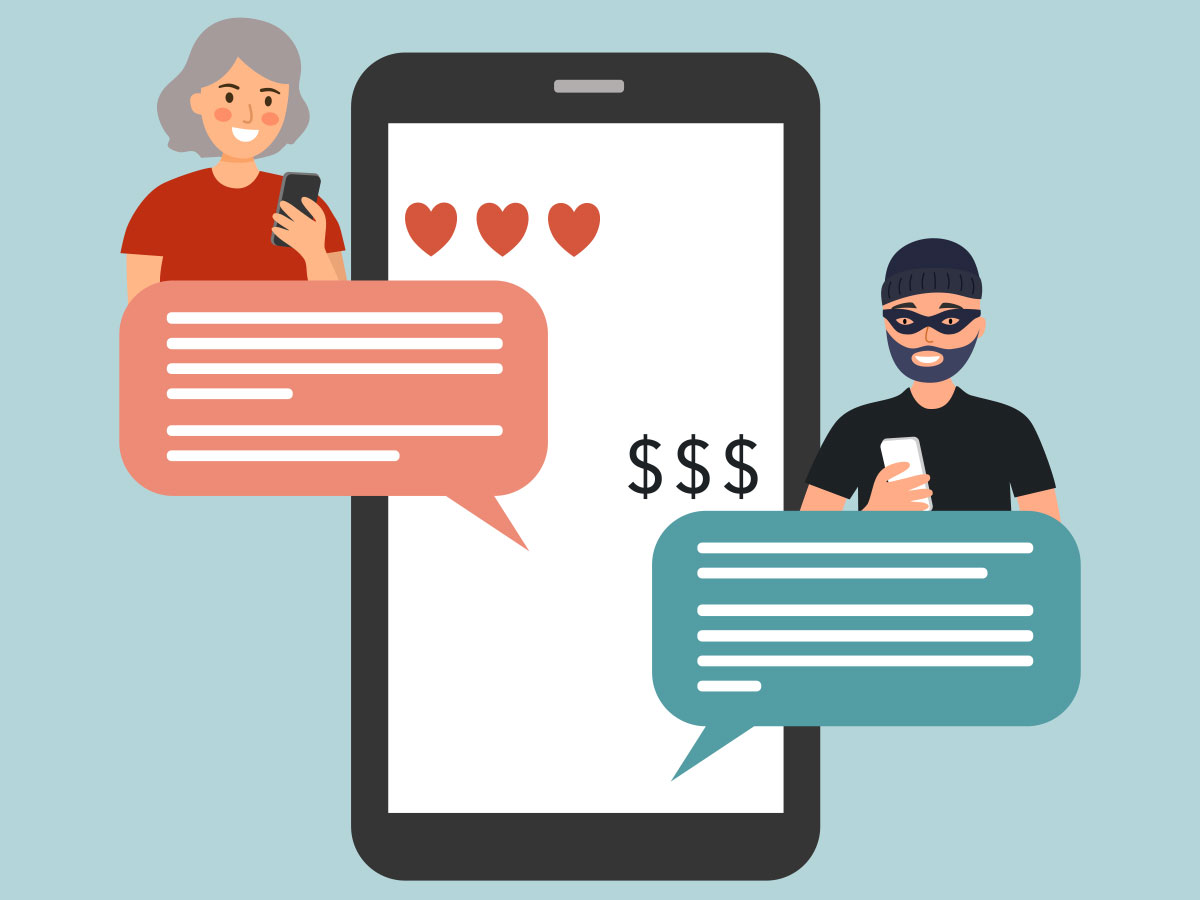

Romance Scams

It’s called a “long con,” meaning that the scammer can invest months building trust. They’ll often have extended phone and video conversations, so the targeted senior has a friendly face to go with the fake name and made-up backstory.

The request for money often comes right before the couple is to finally meet in person. The scammer will invent some 11th-hour obstacle that, they’ll claim, can only be solved by a large amount of money being sent by wire or online transfer. Once the fraudster receives the money, they are never to be heard from again.

Grandparent Scams

Scammers are nervy enough to pretend to be their target’s grandchildren! They’ll reach out to report a fake emergency that requires a large sum of money to resolve.

Tech Support Scams

By phone, email, or through social media, fraudsters will initiate contact while posing as a support representative from a major tech company. Then this scam can go a few ways. The fake tech agent may charge an exorbitant amount of money for a repair that isn’t needed. Or they may ask for access to the computer, which usually has more than enough information for identity theft.

Windfall Scams

The false claim here: A large inheritance from a distant relative or a lottery/sweepstakes win. The catch: The scammer claims that taxes or fees must be paid in advance to receive the money.

Even if you’re suspicious, it may be tempting to take a risk for a large payout. Just remember this: Legitimate lotteries and inheritances will not require upfront money. Always be suspicious of winning a sweepstakes you have no recollection of entering.

We’re Here to Help

As your financial partner, if you’re in doubt, ask for help. If you’re about to give away a large sum, always ask questions first. Our goal is to help members stay informed on current scams and new forms of fraud.